Last updated April 2025

Contents: When Does Commercial Rooftop Solar Make Sense in Kansas?

Please note; much of the discussion in this article is dependent on current political and public infrastructure environment; such as subsidies, grid rates, and power exchange policies. As any of these are subject to change, the information herein should be considered general/conceptual, and only as of the “last updated” date published at the top of the article. The information herein should not be considered tax, legal, nor investment advice.

Bias statement: Rhoden Roofing does not perform any solar installation work, nor have any direct financial interest in solar arrays. This guide is a resource to our community because the financial viability of commercial rooftop solar is a question asked by our customers as they consider options for their property. Rhoden Roofing, LLC is a residential and commercial roof and gutters contractor licensed in the state of Kansas, and performs roof replacement and repairs, guttering, and skylight work.

Background

The question of commercial solar viability is on people’s radar as small-scale residential solar is becoming more financially viable here in Kansas. While financial feasibility of commercial solar is still challenging within the state, business and commercial property owners have been asking more in recent years about the viability of commercial rooftop solar development.

Solar energy production in the US has risen steadily since the 1980s. Technological increases in panel output, decreasing prices over time thanks to manufacturing innovation and scale, and increasingly favorable regulatory/political environments have been the main contributing factors to make solar power more financially accessible over the last 30-40 years. Many other factors impact the cost to install or the financial benefit of installations over time; the two variables that determine the financial break-even point of solar installations.

Commercial rooftop and large-array solar remains challenging to make economically viable in Kansas for most property owners. Unfavorable regulation surrounding “net metering” (selling excess power back to the power grid), combined with low energy prices relative to other parts of the country, mean that break-even timelines are longer in Kansas than elsewhere. In general, many more projects get started once political and economic conditions make breakeven timelines around the 5-year mark or shorter after initial investment to build a solar array.

Environmental sentiment and interest in renewable energy have been tailwinds for regulatory changes and business’ ability to market solar energy. Power infrastructure is tied to federal, state, and local regulation. Laws, policies, and subsidies all impact the economics of solar installations. Changes can occur quickly and unexpectedly. As solar energy production increases across the country, many consider Kansas to be close behind nearby states that have implemented more solar-friendly policies, and are waiting for policy changes that would impact the viability of large, private solar installations.

In order to understand the current landscape on private solar energy production in Kansas and the various factors that determine whether a project is viable, we have detailed the main considerations for commercial rooftop solar installation.

Differences Between Residential and Commercial Rooftop Solar

When we discuss private commercial solar, we are talking about non-government, non utility-company-owned solar arrays installed by building or land owners. For rooftop applications, this means warehouse, industrial, hangars, etc – low-slope (usually called “flat”) roofs, generally greater than 100,000 square feet.

In general, people are more familiar with residential solar installations, so it’s helpful to use the comparison to understand how projects change at a much larger scale.

At its most basic level, the concept is the same: solar power is generated from rooftop arrays. The power generated offsets power consumption in the building, or if production exceeds consumption, the excess power is put back into the public grid. Excess power put back into the grid is “sold” back to the area power utility in a process called “net-metering.” How the local power utility is required to treat net metering is critical to the financial viability of any private solar array, so we discuss it at length in its own section.

The business of designing and installing residential vs commercial is totally different. Residential solar is a straightforward, repeatable process sold to customers, sometimes even door-to-door. On the other hand, a commercial deal is usually only possible with the help of a developer. A comparable analogy might be the difference between a bathroom remodel and building a neighborhood.

The most noticeable structural difference between residential and commercial applications is that in residential, the solar array owner is usually the same as the building owner and the building occupant/power consumer. This could be true in a commercial setting as well, known as a host-owned system, but third-party owned systems are more common. We go into more detail on array ownership structures in its own section below. Editorial note; some residential solar providers use equipment lease structure, although host-owned is by far the most common structure in residential)

Commercial deals usually involve the following: government tax credits, subsidies, coordination and/or negotiation with the local power authority (including an engineering review from the utility provider prior to interconnection), outside financing, and a capital partner to monetize tax credits, .

Both commercial and residential solar applications have varying break-even points that offset the initial investment, depending on where you are in the country. However, homeowners are generally able to be “more patient” on account of the smaller up-front costs, longer-term horizon of how long they might own a property (i.e. “forever” home), or secondary factors, namely environmental interest. Private commercial arrays are often financial investments, and as a result of underwriting needs for financing, are subject to requirements about a specific (shorter) breakeven point.

Residential applications rarely require any structural changes – adding some panels to a sloped roof on only one side of a house does not add substantial weight. On the other hand, adding hundreds or thousands of panels and racking frames to hold those panels at an angle facing the sun may exceed current load ratings, especially on older buildings or lightweight purlin/metal roofs.

Ownership Structures: Private Commercial Solar Arrays

Privately-owned (non-government) solar arrays are classified as IPPs (Independent Power Producers). Several ownership structures are used for IPP solar that are applicable to commercial rooftop arrays:

-

- Host-owned system

- Third-party-owned system

- Power Purchase Agreement (PPA)

- Equipment services lease

The simplest form is what’s called “host ownership.” In this case, whoever owns the building also owns the array system. On these systems, the building owner provides the capital investment, and is the direct beneficiary of the power generated (whether they use that energy on-site or sell the power back to the grid), as well as receive any tax credits received from installation.

When a third party owns the system, the structure is often arranged with a PPA, or ‘power purchase agreement.’ In this scenario, the array owner is a different party from the building owner. The array owner, or “system owner,” is the power producer, and the occupant of the building is the consumer of the power, called an “offtaker.” Those are the two parties of a power purchase agreement. The power purchase agreement is negotiated at a rate that is beneficial to both parties. The offtaker has guaranteed power rates at a discount for the term of the contract, usually 30 years, and is protected from demand charges because the agreements are usually written to be constant per kWh. The PPA provides array owner/power producer guarantees steady income over the lifetime of the system, and are usually written with an escalator of 1.5-3% annually.

An equipment services lease is a slightly different (and less common) alternative to a PPA, wherein the payments by the offtaker are structured as a fixed lease. Using a lease transfers the power production “ownership” to the offtaker, who becomes the direct beneficiary of power generated and excess power sold back to the grid.

Why does who owns the array matter so much? Whoever owns the system must use the tax credits. They are not transferable. The only alternative to shift tax credit benefit is via a tax equity investment; a complex ownership structure with minority ownership from an outside investor.

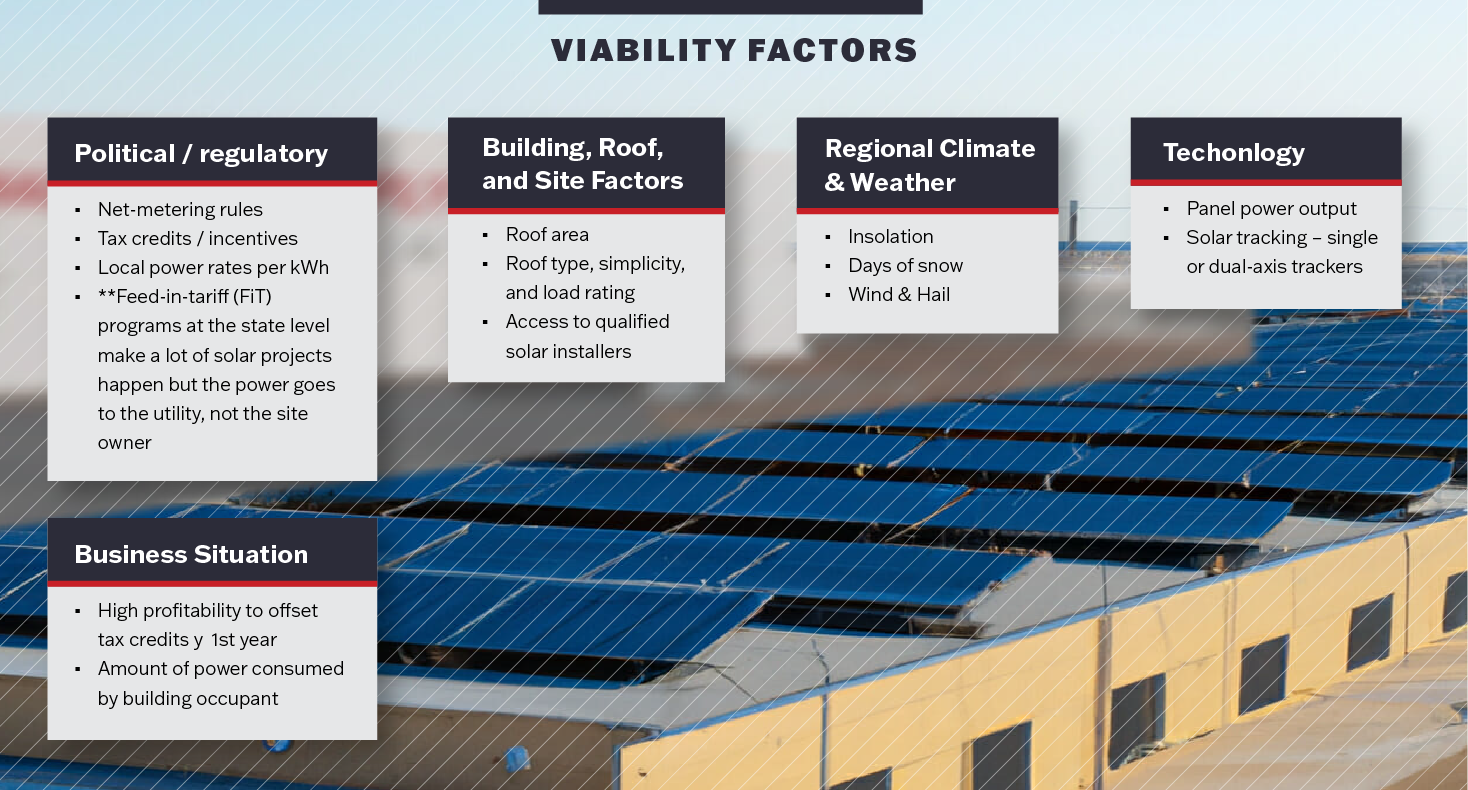

Viability Factors

What is Net Metering?

Net metering is a mandate to the power utilities to buy back extra power produced by privately owned solar arrays. Essentially it is the process of getting paid by the power utility company when you run your electricity meter ‘backwards,’ providing power into the grid. Unless required to by law or mandate, utility companies do not pay net metering – after all, a utility provider is an area monopoly with no financial interest in paying their customers to stop consuming power.

Net metering comes into effect during daytime hours when the solar array is producing the most energy. Because of the size of commercial solar installations, peak power production virtually always exceeds onsite demand. This often makes net metering the single biggest factor for what the break-even timeline of a solar array will be.

Net metering could be mandated by state or local laws. Requirements vary by jurisdiction, and the purchase price paid by the utility ranges from zero (no net metering) to full retail pricing (credits at 100% of what the consumer would pay for grid power). Even if the utility companies are required to pay net metering, it is usually not at full retail power prices, which introduces financial inefficiency to producing beyond local demand. The utility provider may only pay “avoided cost of production” (often pennies on the dollar relative to retail price), or “wholesale power cost” based on alternative grid power sources, or a fixed percentage of retail price, or a cap rate based on grid demand at the time, or any other formula written by the applicable governing body.

PACE – Property Assessed Clean Energy Program

PACE – Property Assess Clean Energy Programs, a national government-funded financing program allowing energy efficiency and renewable energy improvements on private property. Implementation varies by state, and is not currently available in Kansas. Commercial programing, commonly referred to as C-PACE, allows a property owner to finance the up-front cost of eligible improvements with a series of future tax assessments on the property tied to the building (and transferred when sold). The tax assessments are also senior to the mortgage. PACE financing encourages longer-term investments in clean energy solutions even when the ownership horizon of a property is shorter than, in this example, the financial break-even point of a solar array.

Building, Roof, and Site Factors

These are written as some general guidelines to help identify what building/roof types might be a good fit for private rooftop solar installations. This is not Kansas-specific.

- Large – This is variable based on the market and what size deal is needed to bear the overhead costs of doing an array. Roofs, relative to ground solar installations, are space-constrained. 100,000 square foot rooftops are considered “large.” There are ways to increase site efficiency when facing space constraints, such as adding single-axis panel tracking (follows the sun during the day, semi-common) or dual-axis tracking (uncommon based on prohibitive up-front costs). However, site size/number of panels is still the leading factor on installation output.

- Age/condition of roof. In general, it only makes sense to install solar on a new or relatively new roof. Replacing a roof with an existing solar installation requires a ‘detach and reset’ – taking all the panels off, replacing the roof, and reinstalling the panels. This cost alone could push out a financial breakeven point for a project to beyond what the business is willing to accept. As a general guide, most solar panel manufacturers warranty their products for 25 years, which is similar to many commercial roofing products. In practice, the expected actual life of both roof and array is longer than 25 years, but this is the time period normally used when making a financial model of expected life for energy production. Certain provisions within the Investment Tax Credit allow part of the cost of roof replacement or repairs to be included in the total project setup cost of a solar array in some situations. This is usually when the expected life of the array exceeds the expected life of the pre-existing roof. The Investment Tax Credit, referred to as ITC, was re-upped and enhanced by the Inflation Reduction Act of 2022. Note that high-coverage solar arrays protect a roof from deteriorating UV and hail impact, so expected roof life is factored differently with arrays vs without arrays. Another situation applicable here might be needing to move HVAC units on the roof in order to clear space for the array – a process that could require roof repairs.

- “Clean” – flat, and not a lot of encumbrances on it (HVAC units, penetrations, elevator towers, etc).

- Big power consumer – the more power the business using the space needs, the more meaningful the offset will be. Manufacturing, machining, materials processing, server warehousing, and certain agricultural applications, are typical examples.

- Weight-load capable. Newer buildings are usually fine, but an engineer may need to be involved when evaluating a commercial property for solar to make sure weight loads are capable for 3-6 pounds per square foot for traditional solar panel arrays.

- Black roof vs white roof – white roofs perform better for solar arrays because they’re light-reflecting. Because rooftop installations are space-confined, increasing the efficiency of the panels can be important to the financial viability of the project. Installing bi-facial (two-sided) panels is one way to increase efficiency, and is more relevant on a light-reflecting white roof. Temperature differences between black roofs and white roofs also have a limited affect solar array performance, but much less meaningful than the variance in light reflection.

- Roof type – for the most part, all flat roof types are compatible with solar arrays. Membrane (also called ‘single ply’) roofs – that is TPO, PVC, EPDM (including ballasted rock-covered EPDM), or modified bitumen materials – are all compatible, as well as built-up roofing. Large solar arrays on flat roofs are usually ballusted; connected together and weighted down, and do not need to be screwed to decking through the roofing membrane. Low-slope metal roofs can be compatible with solar, but are the most likely to have load weight limitations (e.g. airplane hangar building), and have the greatest concern with mounting penetrations if required through the metal.

What is Insolation?

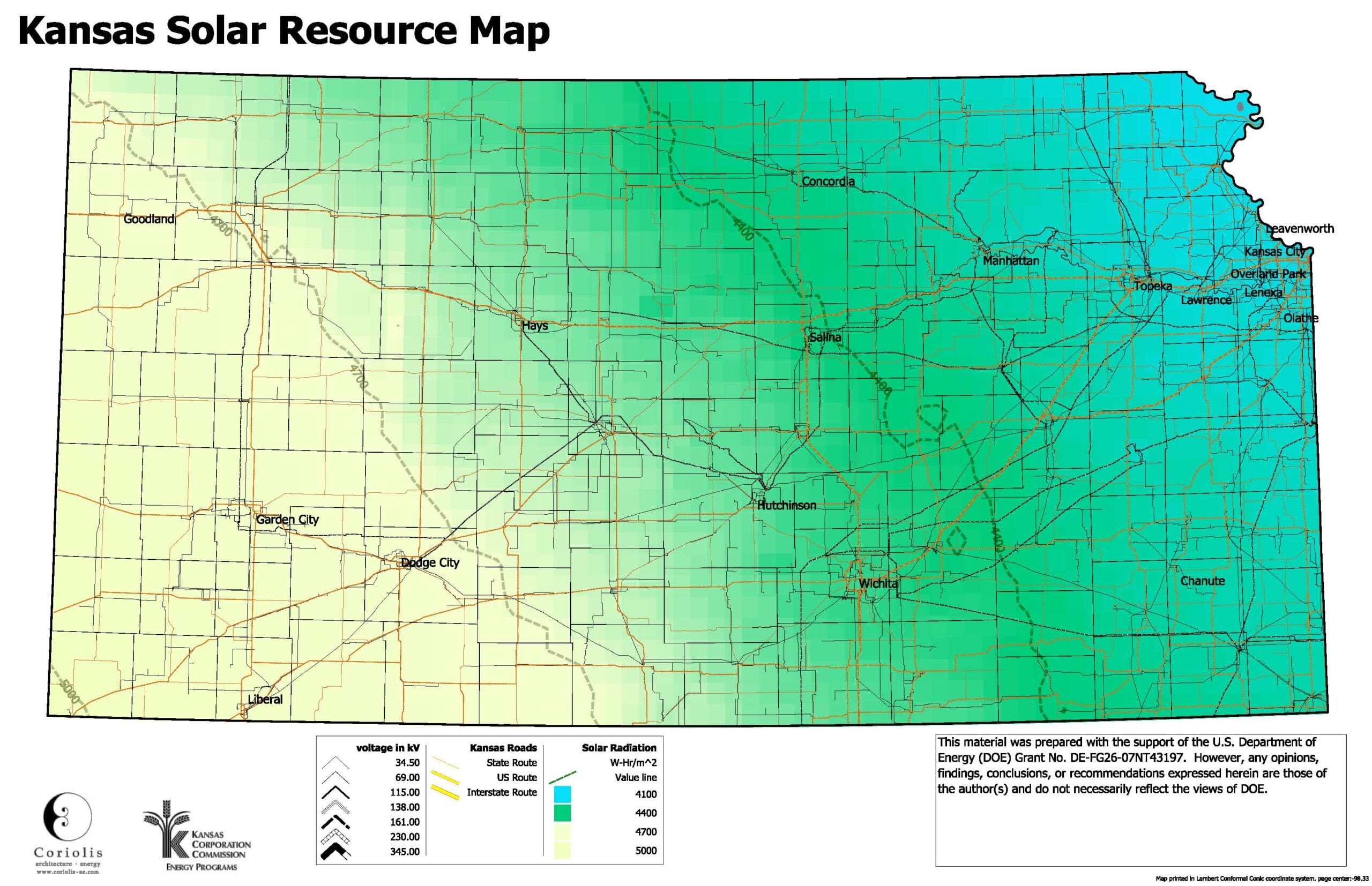

Insolation calculation of the amount of solar radiation that reaches the surface of the Earth in a specific area. It is typically measured in units of energy per unit of time, such as watts per square meter, and is often expressed as a daily or monthly average. It is affected by a number of factors, including regional climate, time of year, the latitude of the location, the angle of the Sun in the sky, and the presence of clouds or other atmospheric conditions such as agricultural dust, smog, or smoke. In short, it is the primary measure for the amount of energy that is available for solar power generation.

Insolation is usually measured regionally, which works well in a flat area like here in Kansas (which has minimal local topography like mountains), but note that adjacent features affect site insolation. Neighboring buildings, silos, towers or elevator stacks on a roof, in addition to roof slope.

Insolation is not the only climate factor in measuring actual solar energy that reaches the patterns, e.g. snow that covers the panels for a few days, or fallen dust or wildfire ash.

Kansas solar output – data courtesy of Kansas Corporation Commission, kcc.ks.gov

What Markets in the US Are Examples of Private-Solar-Friendly Environments?

Good rebate incentives are a major driver in what makes a good market for private commercial solar development. Because installation costs are high for a commercial array, the business either has to have a lot of tax liability to offset or you have to have what’s called a tax equity partner in order to monetize the tax credits. In the case of a non-profit business, which doesn’t have taxable income to offset, there is now a program under the (year) Inflation Reduction Act that includes some direct pay provisions for those federal tax credits.

- New York has good state incentives, and established the Value of Distributed Energy Resources (VDER), which developed a new mechanism to compensate energy returned to the grid using a different methodology than net metering with the goal of a “fairer” valuation.

- Massachusetts has Mass SMART, a feed-in-tariff (FiT) program. This is set up a little differently that programs we’ve discussed so far, but means that an energy producer is compensated directly to contribute to the grid. This provides stable revenue to the power producer.

- New Jersey’s Clean Energy Program created a streamlined process for registering solar projects to access SRECs (Solar Renewable Energy Credits) and bolstered infrastructure to support private solar investment.

- Hawaii is a fairly viable private solar market simply because the price of grid power is so high – overpowering other factors in the state; even while space constrictions and expensive cost of installation are both relevant there.

- California similarly has expensive grid power, which makes breakeven timelines on private solar more attainable. Paired with a solar-friendly political environment, and reasonably good insolation, it is a leading market for solar.

- Arizona’s climate makes it one of the leading solar markets, with really high insolation and possible energy production yields.

- Illinois has had a number of political changes proposed between 2019 and 2022 that have put the state as a likely market for viable commercial solar on the horizon.

A more simple incentive that states can provide is to guarantee net metering rates, which negates the need for a solar array owner to negotiate with the off-taker. States can put a floor on allowable net metering; and because the percentage (or dollar) value is variable, this can be a process for incremental change to slowly encourage non-government solar development.

What is the Current Political Environment in Kansas Regarding Private Solar Development?

Kansas has no state solar subsidy. Kansas also has energy rates that are low relative to many states, but rising energy costs nationally between 2022 and 2024, often as much as 20% increases per kilowatt hour, have put pressure on changes favoring private energy production and renewable power generation.

Net metering rules in Kansas are minimal, meaning that here in Wichita (and likewise across the state unless individual power corps or municipalities have different set policies), the utility buys back at wholesale rate.

Kansas’ production credits system (energy production credits) were subject to favorable changes following COVID, allowing Kansas solar producers to use a one-month timeline. This means that if a solar producer overproduces (relative to their power consumption) in July, the business could use those credits in August, but not after. This change is an improvement toward making rooftop solar financial viable in more circumstances. However, the 1-month limit is still a challenge because solar energy production is affected by seasonality – summer production might be 50% higher than winter – meaning credits would be most useful in winter, rather than adjacent summer months when energy production is still high.

What Partners Are Involved in Making a Private Commercial Solar Project Happen?

A commercial solar infrastructure broker works to find the right situations for an array site, coordinate the details of a prospective project with the various private, utility, and public parties, and pull together the economics of a prospective project. This team will make sure the project gets financing, and completes the development phrase. From there, the system can be sold to what’s called an IPP, an independent power producer, which is essentially a large portfolio holder that wants to own solar arrays across many properties and monetize the tax credit, but doesn’t want to handle the logistics of each individual installation or doesn’t hold the properties themselves.

Building and Roof Considerations for Commercial Solar

As the financial viability of solar arrays increases, commercial building owners should be aware of the factors that make for a viable array site. These are written as some general guidelines to help identify what building/roof types might be a good fit for solar installations. This is not Kansas-specific, but merely meant to illustrate the buildings within a market that are likely to be the first to develop as market conditions in an area gain favorability:

- Large – often 100,000 square foot rooftops and up

- “Clean” – flat, and few encumbrances on it such as HVAC units, penetrations, elevator towers, etc

- Large power consumer – the more power the business or tenant using the space needs, the more meaningful the offset will be. Manufacturing, machining, materials processing, server warehousing, and certain agricultural applications are all examples from other markets that are the first to be able to make financial use of solar arrays

- Weight-load capable. Newer buildings are usually fine, but an engineer may need to be involved when evaluating a commercial property for solar to make sure weight loads are capable for 3-6 pounds per square foot for traditional solar panel arrays.

What Solar Technologies Are Coming Out Making Private Arrays More Feasible?

Roll-out adhesive panel technology (sometimes known as “lick-and-stick”) don’t require specialty installers or racks. These have started to make appearances in residential applications (and hobbyists, such as camper vans, RVs, etc.). At scale, these membrane-like flexible panels are not cost-effective, but as manufacturing volumes increase, prices can be expected to drop, getting these closer to financial viability especially at scale, such as for commercial installations. These roll-out panels still require a master electrician to connect all the inverters, and then the utility authority to connect to the power grid.

Publication Notes

Disclaimer. Neither Rhoden Roofing, LLC, nor any of its respective directors, officers, members, employees and agents, provides accounting, legal or tax advice.

Circular 230 Disclosure: To comply with regulations issued by the IRS concerning the provision of written advice regarding issues that concern or relate to federal tax liability, we are required to provide to you the following disclosure: Unless otherwise expressly reflected herein, any advice contained in this document (or any attachment to this document) that concerns federal tax issues is not written, offered or intended to be used, and cannot be used, by anyone for the purpose of avoiding federal tax penalties that may be imposed by the IRS or promoting, marketing or recommending to another party any matters addressed in this document or any attachment.

Rhoden Roofing, LLC is a residential and commercial roof and gutters contractor licensed in the state of Kansas, and performs roof replacement and repairs, guttering, and skylight work. This article was made possible with the help of Uneva Energy Group, based out of Denver, Colorado.

This article is part of our ‘Low Slope and Commercial Materials’ Series. Learn more about:

System Types and Surface Materials

- TPO vs EPDM

- TPO vs PVC

- Mechanically Attached vs Fully Adhered Roofing Systems

- Black Roofs vs White Roofs

- Is a Metal Roof Right for My Commercial Property?

- Can a Commercial Roof Coating Save Me Money

- 3 Best Commercial Roofs in Wichita, KS

Substrate Systems

- Polyiso Insulation vs EPS Insulation

- What Do I Need to Know About Tapered Roofing Insulation Panels?